how much does a property tax lawyer cost

They will file the necessary paperwork represent you in. The average cost for a Tax Attorney is 250.

Cause Unfair Taxes Tax Lawyer Tax Attorney Retirement Planning

The slightly longer answer is that the cost to file your taxes with a tax pro will vary based on a.

. Standard attorney fees can range from 250 an hour to 600 an hour but their rates vary beyond this estimate based on their location and specialty. When you purchase a home youll need to factor in property taxes as an ongoing cost. Start Fighting For Your Rights.

Specialized lawyers with a lot of expertise in a specific area of law such as patent or intellectual property law could. - Answered by a verified Lawyer. Get Access to a Team of Real Estate Lawyers for only 2995Month.

Assume that Billy Blue Devils house in Carolina County is sold at a foreclosure sale by Carolina County and that Billy owed a total of 1000 in taxes costs attorneys fees. Nationally the average minimum hourly rate attorneys reported was 250 while the average maximum was 310. You might also expect that lawyers charge higher rates as they gain more experience.

Legal Advice for any Area of Property Law Including Buying Selling Resolving Disputes. Ad Largest Network Of Attorneys. How much does a property tax lawyer cost.

How Much Does It Cost to Get Your Taxes Done. Total official costs involved in purchasing property should be around 1. Search by Practice Area.

A tax attorney will charge on average between 3500 to 6000 to handle an Offer in Compromise for you. If an attorney charges a flat fee it will generally be around 1000 to 4000. Standard legal fees for criminal cases and.

Ad Real Estate Attorney 345 Law Offices. Individual lawyers often charge different rates depending on the. Get Your Free Real Estate Consultation Recommended.

Your attorney will complete Form 656 to get your case started. The short answer is. Ad Our Plans Offer Affordable Access to Legal Advice Assistance.

Tax attorneys generally charge either an hourly rate or a flat fee for their services. For negotiating minor settlements with the IRS you may pay 700 to 1500. All About Property Taxes The map indicates the relative cost of property taxes across the US.

Lawyers fees approx10 of the selling price dependant upon the solicitors set fees. Types of Tax Attorney Fees. I entered into a lease for commercial space May 2009 and just recieved a.

Join as a pro. Agents are paid by the. Our study bore out that expectation with average minimum and maximum rates.

The average cost for a Tax Attorney is 250. Get Access to a Team of Real Estate Lawyers for only 2995Month. In that case we can agree on the fact that for those lawyers who charge a fixed fee for standard cases it can be anything between 500-1500 for a standard one family single.

To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total. 100 Private and Fully Confidential. Get Your Free Settlement Claim Review With A Top Law Firm Now.

Ad Our Plans Offer Affordable Access to Legal Advice Assistance. Up to 20 cash back How much does a tax lawyer cost. For simple cases that require only a moderate amount of legal representation you may pay 2000.

Ad You Have Rights. A lawyer in a big city could charge 200-400 per hour. A tax attorney provides legal advice to individuals businesses and organizations about income estate gift excise property and other local state federal and foreign taxes.

The majority of tax attorneys charge by the hour.

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Pin On Chartered Accountants Cost Accounting Architectures In Delhi Ncr Ipso Management Private Limited Charteredaccountancy Directtaxation

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

India S Kolkata Municipal Corporation Kmc Is Finally Set To Implement The Unit Area Assessment Uaa For Dete Property Tax Tax Attorney Municipal Corporation

Taxes And Fees For Buying A House In Toronto Estate Lawyer Real Estate Contract Real Estate

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Tax Lawyer

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property

Brylaw Brylawaccounting Brylawaccountingfirm Accounting Incometax Tax Income Tax Tax Lawyer Quotes

Use Our Tax Calculators And Find Great Information About Taxes Estate Tax Property Tax Tax Deductions

Consult Goldburd Mccone To Reduce Risk And Abate Your Taxes Small Business Tax Business Tax Indirect Tax

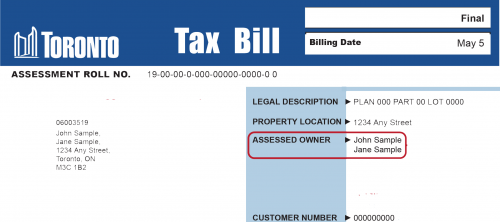

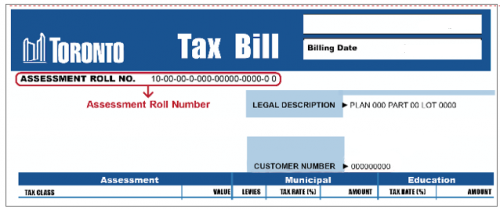

Buying Selling Or Moving City Of Toronto

Pin Slamming How To Avoid Unexpected Property Taxes Real Estate Fun Property Tax Real Estate Buying

Consult Top Property Tax Expert Lawyer In India Tax Lawyer Property Tax Legal Advice

Property Rights And Property Taxes And Countries That Don T Have Them Tax Attorney Property Tax Tax Lawyer

We Bring A Unique Approach To The Legal Industry By Providing Our Clients With Exceptional Legal Services At An Affordabl Property Tax Tax Attorney Tax Protest

Why You Should Consider Challenging Your Property Tax Assessment Realty Times Estate Tax Tax Attorney Property Tax

Buying Selling Or Moving City Of Toronto

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles