what is suta tax california

In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st. What is SUTA tax.

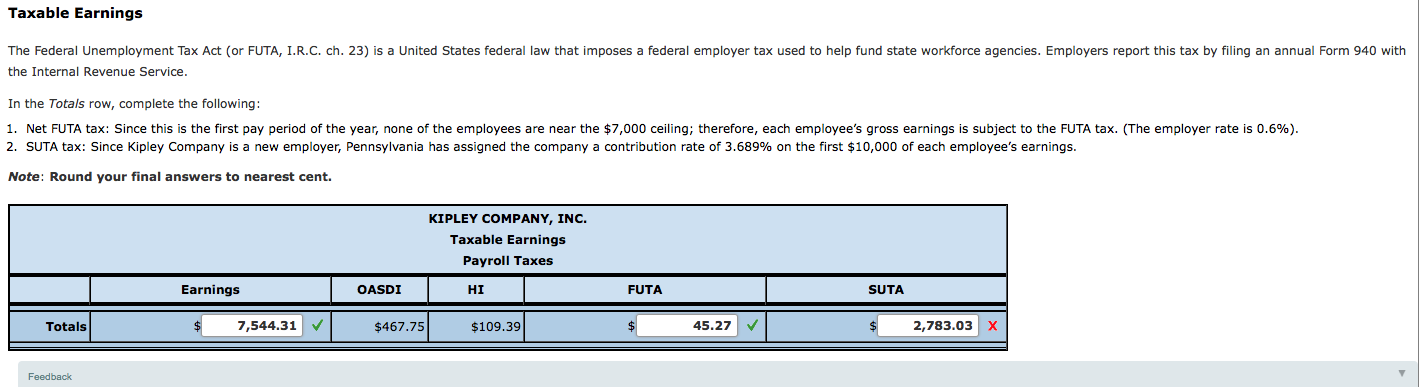

Employer Futa Suta Contributions Understanding Futa Chegg Com

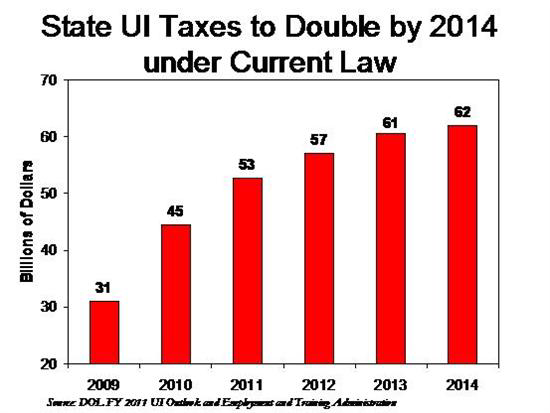

SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates.

. California became one of the first states in the nation to enact legislation as a result of the federal SUTA Dumping. SUTA or the The State Unemployment Tax Act SUTA. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

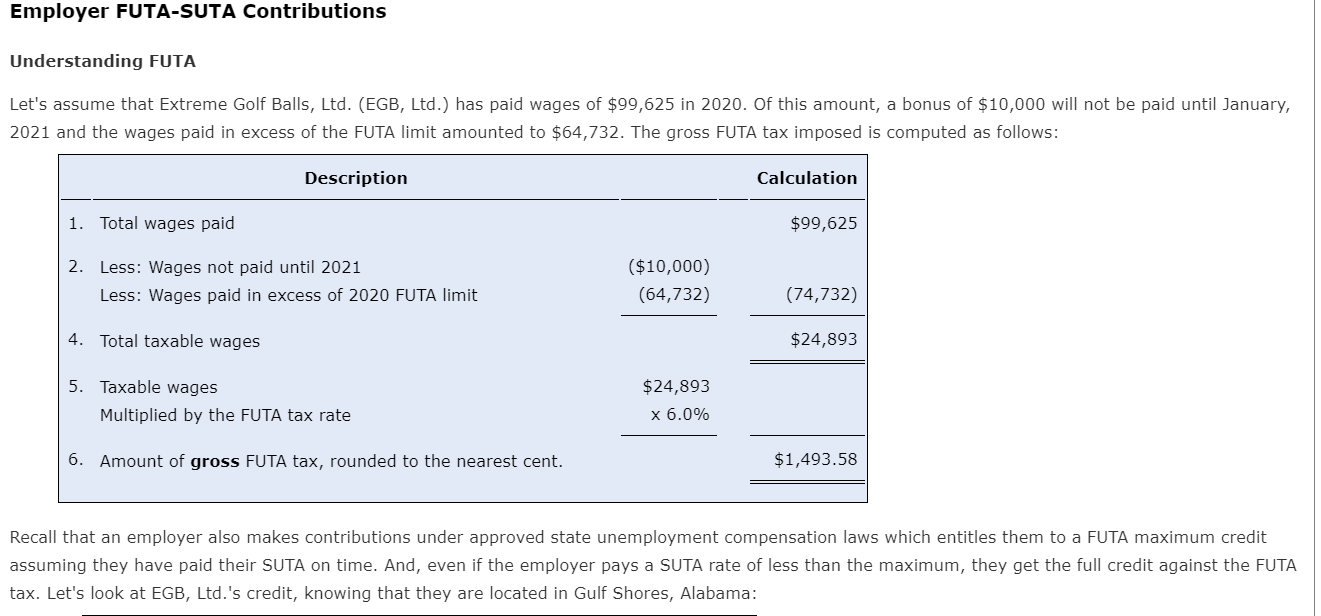

California law defines wages for state unemployment insurance SUI purposes as all compensation paid for an employees personal services whether paid by check or cash or the. FUTA tax rate is 6 of the first 7000 paid to an employee annually. Keep in mind that earnings exceeding 7000 are not taxed and it is the employer who pays this tax and not employees.

What Is A Primary Tax Filer. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

The new employer SUI tax rate remains at 34 for 2021. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st.

We work with the California Franchise Tax Board FTB to administer this program for the Governor. The PIT program provides resources needed for California. See Determining Unemployment Tax Coverage.

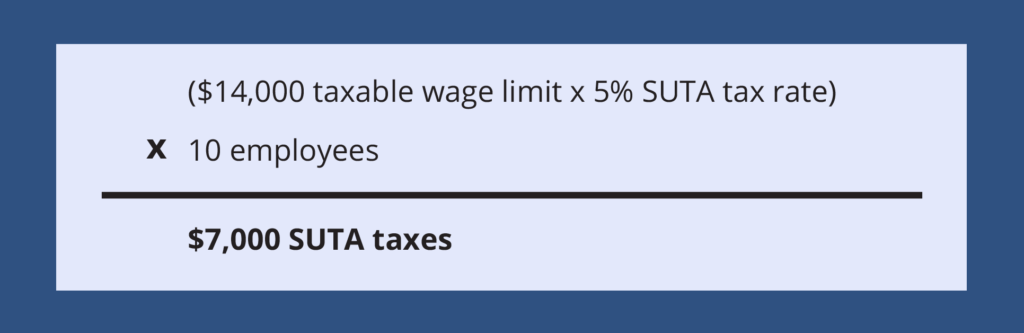

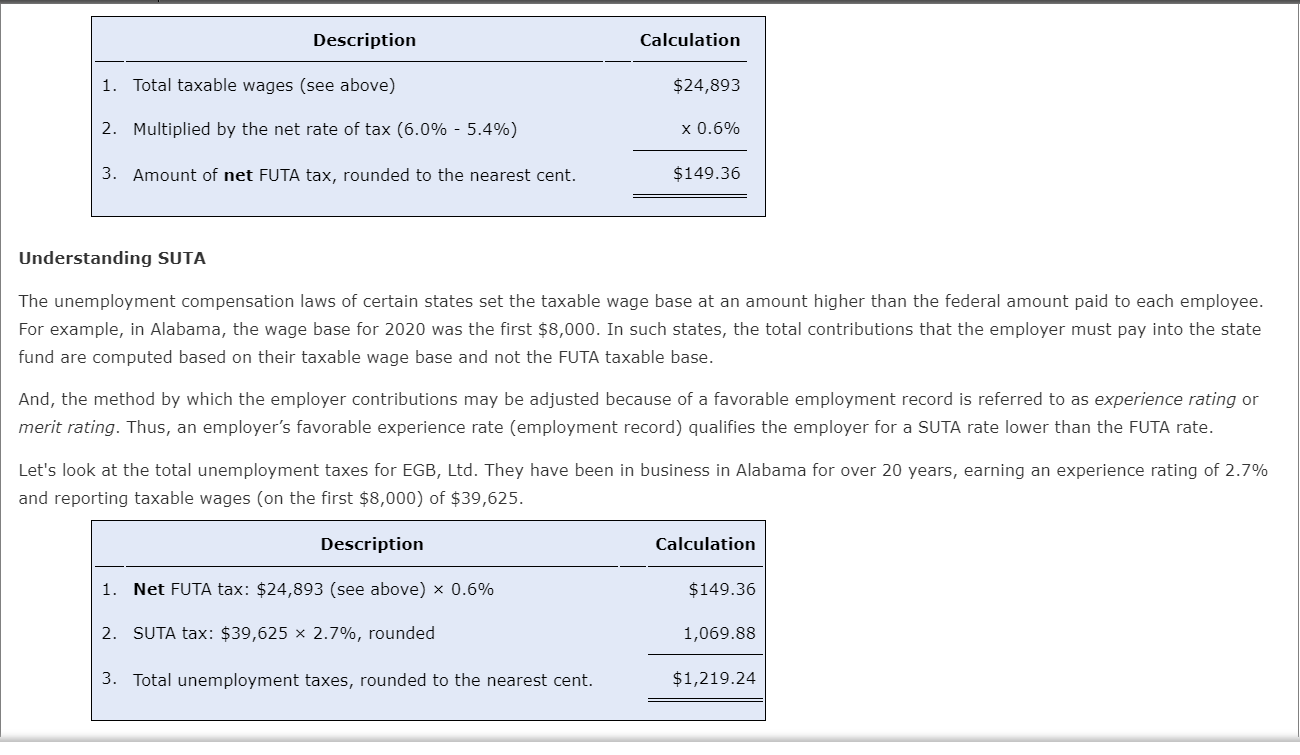

The SUI taxable wage base for 2021 remains at 7000 per employee. Instructor The State Unemployment Tax Act better known as SUTA is a form of payroll tax that all. The State Unemployment Tax Act SUTA is a.

For example if you have eight employees and you pay all of them at least 45000 per year you only need to pay the FUTA tax rate on 56000 total eight employees multiplied by the 7000 FUTA cap. As a result of the ratio of the California UI Trust Fund and the. The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund.

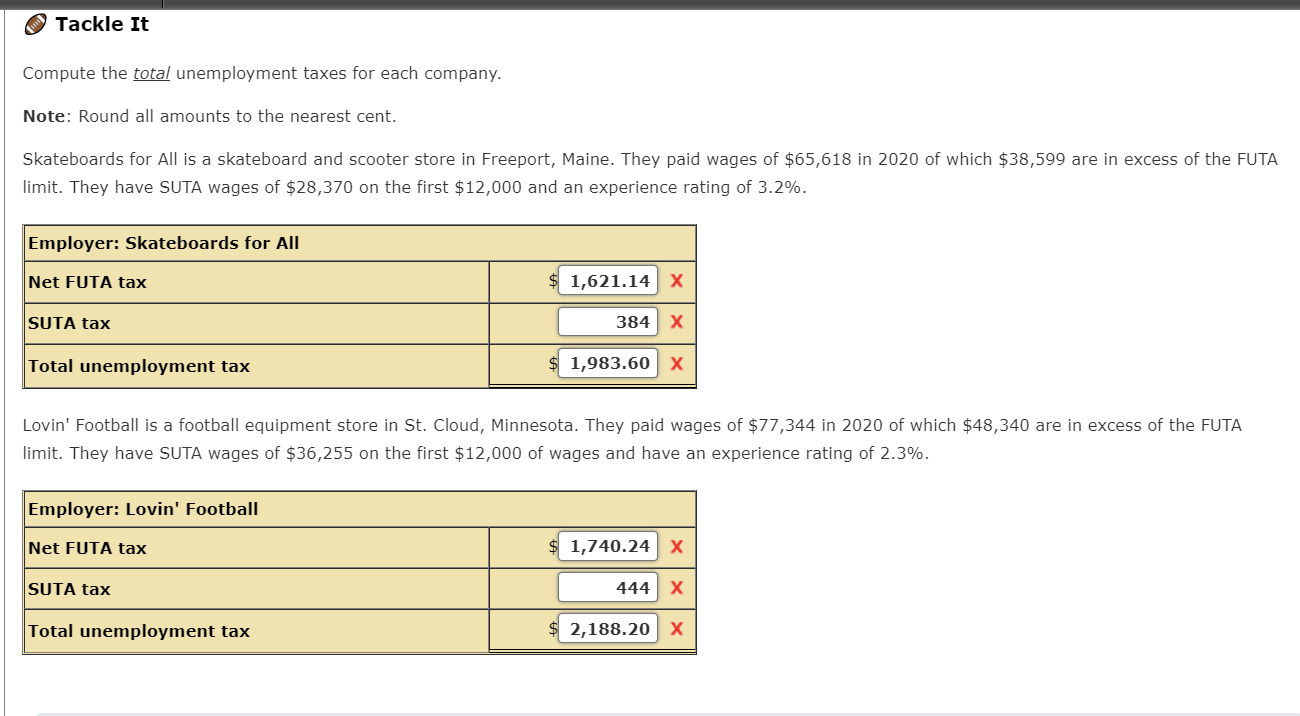

What is the SUTA tax. In most cases states have a range of unemployment tax rates for established employers and each state assigns employers with a rate within this range. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Difference between FUTA and SUTA Tax. Solved Is Sui the same as SUTA. In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st.

If one of your employees ever gets laid off and starts collecting state unemployment insurance its likely that money will come from your states State Unemployment Tax Act fund. PIT is a tax on the income of California residents and on income that nonresidents get within California. We administer the reporting collection and enforcement of PIT wage withholding.

What is SUTA Tax. 2021 SUI tax rates and taxable wage base. State unemployment tax is a percentage of an employees.

Under FUTA f ederal unemployment tax rates are six percent taken on each of your employees first 7000 in wages. You might be interested.

Are Employers Responsible For Paying Unemployment Taxes

State Unemployment Tax Act Suta Bamboohr

Employer Futa Suta Contributions Understanding Futa Chegg Com

What S The Cost Of Unemployment Insurance To The Employer

Suta Tax Your Questions Answered Bench Accounting

Updating Suta And Ett Rates For California Edd In Qbo Youtube

Futa Tax Overview How It Works How To Calculate

How To Reduce Your Clients Suta Tax Rate In 2014

Sui Sit Employment Taxes Explained Emptech Com

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

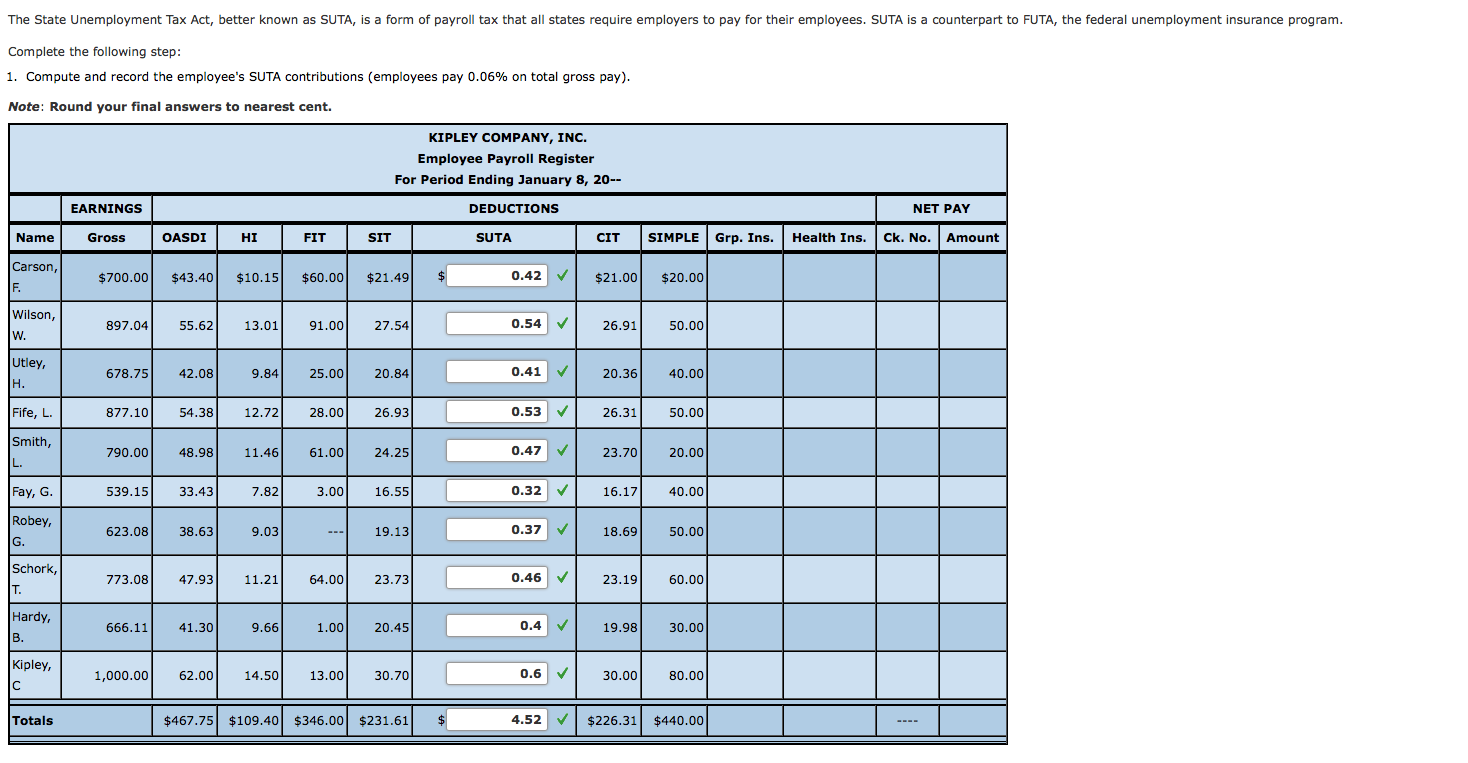

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

Employer Futa Suta Contributions Understanding Futa Chegg Com

What Is Sui State Unemployment Insurance Tax Ask Gusto

Ezpaycheck Payroll Software Futa And Suta

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

State Unemployment Tax Act Suta Bamboohr

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Exclusively Blown For Swank Lighting By California Artist Joe Cariati These Violet Beauties Are From The Second Edition Of Jo Lamp Glass Lamp Glass Table Lamp